The number of states operating state-based health insurance marketplaces has been slowly but steadily rising over the last five years. When the Affordable Care Act (ACA) first required states to choose between providing a state-based marketplace (SBM) or operating through the federally facilitated marketplace (FFM), also known as HealthCare.gov, 14 states and Washington, DC chose to operate SBMs – roughly 30% of the country.

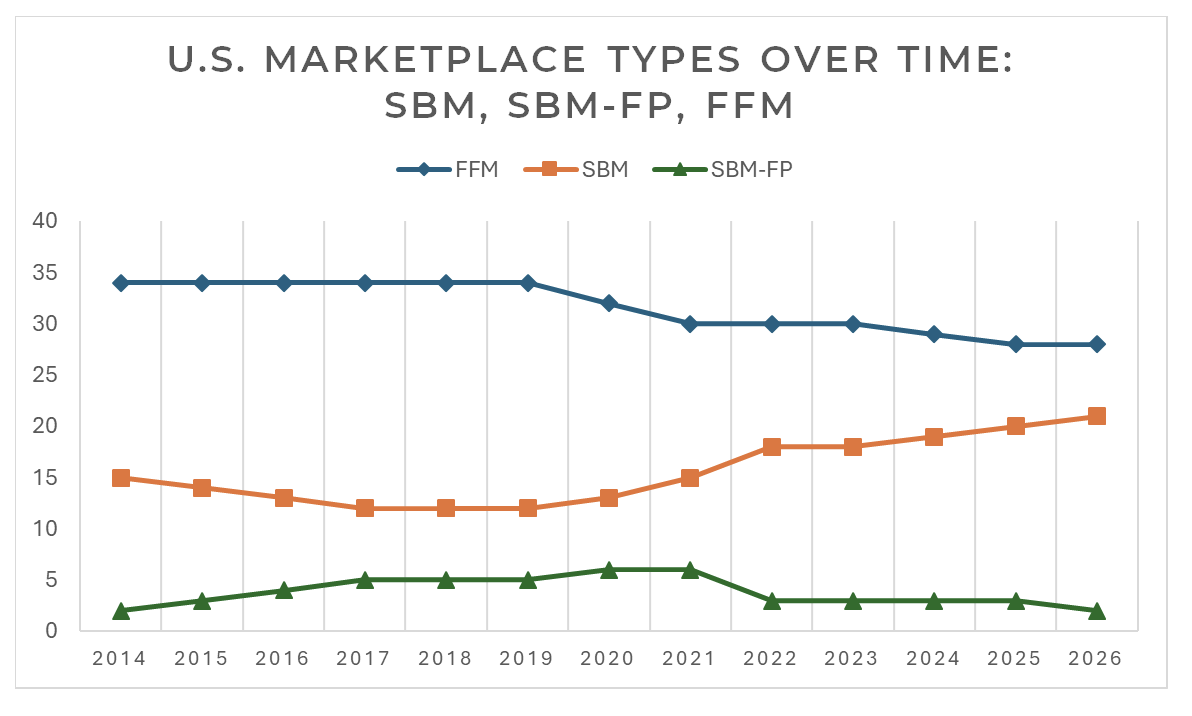

Today, there are 20 states (and Washington, DC) operating SBMs, with another state – Oregon – in the process of transitioning. By the time we get to the end of 2026, approximately 43% of the country will be operating through a state-based marketplace. Figure 1 illustrates the change in the number of marketplace types over time.

Figure 1: Chart comparing the number of states (and Washington, DC) operating on the FFM, as SBMs, and as SBMs on the federal platform (SBM-FPs) over time. Note: Oregon is not included as a full SBM in 2026 because its SBM is not live at the time of this post.

The recent growth in the number of SBMs isn’t coincidental. SBMs offer states enhanced autonomy and flexibility – both qualities that have proven critical in insurance marketplace success in recent years. In this piece, we provide a quick background on SBMs, list the states that are currently operating them, and share some of the reasons states are increasingly choosing to switch to SBMs. We also outline some of the proven, best-in-class tools GetInsured offers to states pursuing the SBM approach.

What is a state-based marketplace?

A state-based marketplace (SBM) is an online platform that allows citizens and legal residents in a specific state to apply for health insurance subsidies and shop for and enroll in health care plans that meet ACA standards. SBMs work similarly to HealthCare.gov, but they are created and maintained by individual states, instead of the federal government.

A Brief History: When the ACA was passed in 2010, each of the 50 states had until 2014 to either create a full state-based marketplace, begin offering enrollment through the FFM, or operate an SBM through the federal platform (SBM-FP). Following 2014, states have had the option to transition models by following specific protocols. As a result of the 2025 HHS Final Rule, states are now required to operate for at least one year as an SBM-FP before transitioning to a full SBM.

Learn more about the state path from the FFM to an SBM.

Which states currently operate as a state-based marketplace?

States that have recently transitioned to an SBM include Virginia (PY 2024), Georgia (PY 2025), and Illinois (PY 2026), and Oregon plans to go live for PY 2027.

SBM states presently include:

- California – Covered California

- Colorado – Connect for Health Colorado

- Connecticut – Access Health CT

- District of Columbia – DC Health Link

- Georgia – Georgia Access

- Idaho – Your Health Idaho

- Illinois – Get Covered Illinois

- Kentucky – Kynect (Kentucky Health Benefit Exchange)

- Maine – CoverME

- Maryland – Maryland Health Connection

- Massachusetts – Health Connector

- Minnesota – MNsure

- Nevada – Silver State Health Insurance Exchange (Nevada Health Link)

- New Jersey – Get Covered NJ

- New Mexico – BeWellnm

- New York – New York State of Health

- Oregon – Going Live for PY 2027

- Pennsylvania – Pennie™

- Rhode Island – HealthSource RI

- Vermont – Vermont Health Connect

- Virginia – Virginia Health Benefit Exchange

- Washington – Washington Healthplanfinder

Why are more states choosing to implement their own state-based marketplaces?

SBMs give states the autonomy and flexibility to make health insurance enrollment more profitable, efficient, and sustainable – and the more data comes out on SBM successes, the more compelling the move to an SBM becomes. SBMs offer states more control over the enrollment process, marketing campaigns, and even enrollment deadlines. This outreach and enrollment flexibility helps states meet consumer needs, leading to more balanced risk pools that not only encourage insurers to stay in the market, but also enable better rates than residents would typically find on the FFM. Many states have found considerable budget advantages by transitioning to an SBM as well. For example, Pennsylvania has reinvested roughly $50 million in projected annual savings by switching to an SBM model.

Recently, SBMs have also made impressive advances in Medicaid-marketplace integration, offering flexibility for Medicaid assessment, determination, and account transfer protocols. This interoperability increases program efficiency and reduces unnecessary gaps in coverage for consumers.

Learn more about how SBMs maximize state autonomy and consumer outcomes.

Read firsthand accounts of how SBMs have impacted consumer lives for the better.

What kind of solutions does GetInsured offer state-based marketplaces?

Since the inception of the ACA, GetInsured has been a leader in SBM implementation, maintenance, and operations, providing technology and Customer Assistance Center services to states across the country. We currently support nine SBMs, with a tenth going live later in 2026.

For states pursuing their own SBMs, GetInsured offers a complete end-to-end solution, encompassing portals designed for consumers; state and customer support staff; carriers; agents, brokers, and agencies; and assisters, navigators, and entities. Our solution leverages powerful modular tools, including a Consumer Decision Support Tool, a Plan Management Module, and an Enrollment Reconciliation Workbench, as well as tools that support call compliance, special enrollment period (SEP) verification, and more.

For states interested, we also offer flexible Enhanced Direct Enrollment (EDE) capabilities and comprehensive, fully integrated Consumer Assistance Center (CAC) services, with an average customer satisfaction score of 94% and 18-second wait time. An optional Interactive Virtual Agent (IVA) is available with our CAC services to further unlock support staff capacity and enhance consumer access.

As states increasingly seek autonomy and flexibility in their marketplace operations, more and more are making the shift to an SBM – has yours?

Learn more about GetInsured’s State-Based Marketplace solutions or reach out to chat with us about your state’s path forward.

Recent Comments